By Quaid Najmi

Mumbai, Dec 21 : In a strange development, the government-backed private sector IDBI Bank Ltd. here has revealed three different figures of the alleged loans defaulted by a well-known diamantaire group, surprising banking and diamond industry circles.

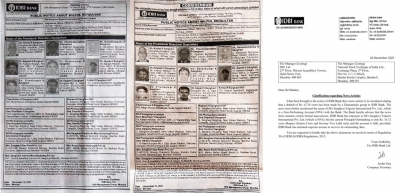

Late on Monday, the IDBI Bank Ltd. in a regulatory filing, clarified an article by IANS (December 20) that the diamantaire group had allegedly defaulted on loans worth around Rs 6,710 crore.

The IDBI Bank Ltd. further said that the company, Sanghavi Exports International Pvt. Ltd., an NPA with the bank, plus other group entities and its promoters/directors/guarantors, only has a current principal outstanding of Rs 16.72 crore and the “account is fully provided” with action taken to recover the dues.

On Tuesday (December 21), the IDBI Bank Ltd. issued a fresh public notice stating that the outstanding amount from the same Group is around Rs 67.13 crore.

“The outstanding amount has been wrongly published on 19-12-2021. Notice of default with correct outstanding is published,” said the new public notice on Tuesday, confounding the banking fraternity.

The IDBI has revealed three contradictory figures of outstanding amounts in just 72 hours, “raising questions over which is the real figure”, said banking expert and All India Bank Officers Association leader Vishwas Utagi.

“This is outrageous… A big bank backed by the Centre and LIC cannot make such blunders, with the upcoming LIC IPO. They must clarify which of the three outstanding amounts’ figure is genuine? If indeed any recoveries are made, they must publicly state when, how much, and into which account,” Utagi demanded.

Slamming the ‘confusion’ and differing statements, Shiv Sena’s Bhartiya Kamgar Sena GS, Dr. Raghunath Kuchik, accorded the Minister of State (MoS) status, asked how — under such circumstances — the government can think of going ahead with the LIC IPO?

“For years, the LIC has been taking care of organised-unorganised labour. I urge the Centre not to put the common man’s money, savings, and confidence into jeopardy till this issue of the IDBI Bank-diamantaire group is properly probed and resolved,” said Dr. Kuchik, who is the crucial Maharashtra Minimum Wages Board Chairman.

Interestingly, the public notices of December 19 and December 21 also clearly mention the outstanding foreign currency component — US$ 161088 — which does not appear in the SEBI declaration made by the IDBI Bank Ltd.

The bank’s SEBI filing stated that “the account is fully provided”, while the two public notices have warned the masses against any kind of dealings with the properties of the Promoters/Directors/Guarantors as huge dues are to be recovered from them.

Interestingly, the IDBI Bank Ltd’s spokesperson and its official communication agency did not respond to a questionnaire sent on December 20 by IANS.

One of the Group members, Aagam Sanghavi — who is named by the IDBI Bank Ltd. in its public notices — also strongly denied the bank’s figures of default (December 19 public notice), and a woman purportedly belonging to the family declined to reveal her fully identity, but contended that the amount in the public notice (December 19) was a “typo” and warned of legal consequences.