BILKULONLINE

Ahmedabad, Sept 16: One97 Communications Limited (OCL) that owns the brand Paytm, India’s leading digital payments and financial services company and the pioneer of mobile and QR payments, today said it is facilitating monthly peer-to-merchants (P2M) transactions worth over 1 lakh crore per month, marking 70% year-on-year increase. This reflects the company’s pioneership in the country’s evolving digital payment landscape, while building customer trust at every step.

The company’s end-to-end payments services continue to be the driving force behind its strong business model that has enabled it to upsell high-margin financial services to its vast consumer and merchant base. With this, the company remains confident about achieving operating profitability by September 2023.

Paytm spokesperson said, “Creating long-term value for our shareholders and customers is a priority for us, as we remain focused on building a large and profitable company. We are committed to strengthening our pioneership in digital payments and drive financial inclusion in India with our innovative offerings.”

Paytm has started off the ongoing financial year on a strong note, with 89% year-on-year revenue growth in Q1FY23 at Rs 1,680 crore, while EBITDA (Before ESOP) loss reduced to Rs 275 crore, marking an improvement of Rs 93 crore Q-o-Q. The company’s contribution profit grew 197% Y-o-Y to Rs 726 crore, leading to an increase in contribution margin to 43% of revenues in comparison to 35% in Q4FY22.

In its latest monthly update for July & August 2022, the company said it has strengthened its offline payments leadership by deploying 4.5 million subscription-based payment devices to merchants across the country.

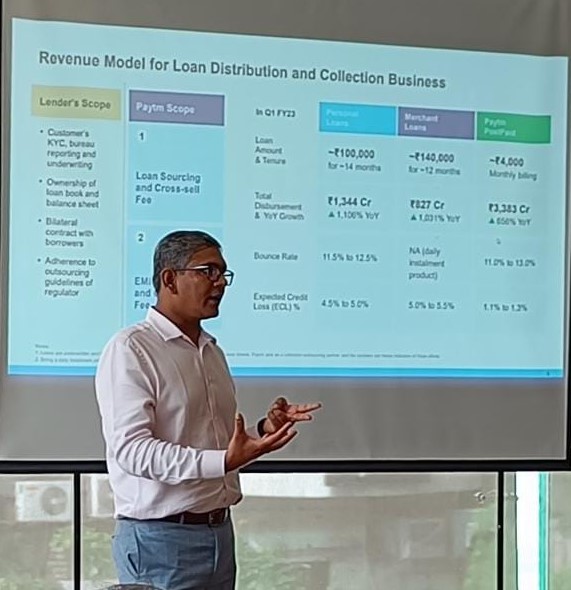

Furthermore, consumer engagement on the Paytm app saw another milestone with average Monthly Transacting Users (MTU) at 78.8 million for the two months. Moreover, the company’s loan distribution business in partnership with marquee lenders has now reached an annualised disbursal rate of Rs 29,000 crore, while it has disbursed loans worth Rs 4,517 crore during the first two months of Q2FY23.