Suraksha Diagnostic IPO Launches November 29: ₹846 Crore Issue with Strong Growth Potential

Suraksha Diagnostic IPO: Promising Growth with 20.87% Revenue CAGR, Opens November 29

BILKULONLINE

Ahmedabad, Nov 27: Suraksha Diagnostic Ltd. is set to launch its Initial Public Offering (IPO) on November 29, 2024, with the issue closing on December 3, 2024. The IPO aims to raise approximately ₹846.25 crores through a Book Built Issue, consisting of a fresh issue and an Offer for Sale (OFS) of up to 1,91,89,330 equity shares with a face value of ₹2 each.

IPO Details:

- Price Band: ₹420 to ₹441 per share

- Lot Size: Minimum application for 34 shares (₹14,994)

- Maximum Application: Retail investors can apply for up to 13 lots (442 shares or ₹1,94,922)

- Listing Date: December 6, 2024, on BSE and NSE

- Allotment Date: December 4, 2024

Investor Quotas:

- Retail: 35%

- Qualified Institutional Buyers (QIBs): 50%

- High Net Worth Individuals (HNIs): 15%

Financial Performance:

Suraksha Diagnostic has demonstrated robust financial growth. In FY24, the company reported revenue of ₹218.71 crores, a rise from ₹190.13 crores in FY23. Profits surged to ₹23.13 crores in FY24, up from ₹6.07 crores in FY23. The company has maintained a compounded annual growth rate (CAGR) of 20.87% in revenue and strong profitability with a net income of ₹23.13 crore in FY24.

Company Overview:

Established in 1992 and incorporated in 2005, Suraksha Diagnostic is a leading provider of integrated pathology and radiology diagnostic solutions, primarily serving eastern and northeastern India. With a comprehensive portfolio of over 2,300 tests, including 788 pathology tests and 647 advanced diagnostics, the company has solidified its reputation in the industry. Suraksha employs 1,522 permanent staff and is headquartered in East India.

Promoters:

The promoters of Suraksha Diagnostic are Dr. Somnath Chatterjee, Ritu Mittal, and Satish Kumar Verma.

Purpose of the IPO:

- To carry out the Offer for Sale (OFS) of equity shares

- To achieve the benefits of listing on the stock exchanges

Lead Manager:

Nuvama Wealth and Investment Limited is the lead manager for the IPO.

With its established market position, consistent financial growth, and extensive network, Suraksha Diagnostic offers investors an opportunity for long-term value, particularly in the growing diagnostic services sector.

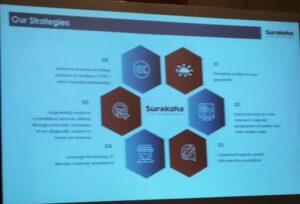

Here are some key insights into Suraksha Diagnostic’s work style, as highlighted in the company’s statements:

- Integrated Solutions Approach:

“We offer a one-stop integrated solution for pathology and radiology testing, along with medical consultation services through our extensive operational network.” - Commitment to Quality:

“Our reputation for providing quality diagnostic services, combined with our dominant position in core geographies, drives our growth and establishes us as a trusted healthcare partner.” - Focus on Regional Expansion:

“Our operating history in eastern India positions us to capitalize on growth opportunities in the diagnostic services markets across eastern and northeastern India.” - Customer-Centric Service:

“We strive to deliver comprehensive pathology and radiology services under one roof, ensuring convenience and reliability for our customers.” - Operational Excellence:

“Our extensive network and commitment to operational efficiency allow us to cater to the diverse diagnostic needs of our customers with precision and speed.” - Strong Workforce:

“With a team of 1,522 permanent staff, we leverage our expertise and dedication to deliver consistent, high-quality healthcare solutions.”

These quotes reflect the company’s dedication to quality service, regional dominance, and customer satisfaction, driving its success in the competitive diagnostic services market.

Visit BILKULONLINE You Tube Channel – Kindly Subscribe & Like.