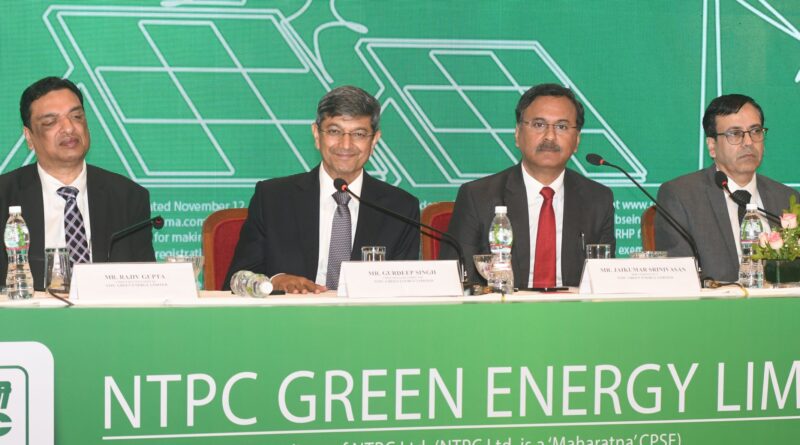

NTPC Green Energy Aims to Power India’s Green Future with ₹10,000 Crore IPO Opening November 19

BILKULONLINE

Ahmedabad, Nov 14: NTPC Green Energy Limited (NGEL), the renewable energy subsidiary of India’s largest power generation company, NTPC, has announced its Initial Public Offering (IPO) of ₹10,000 crore.

The IPO will open on Tuesday, November 19, 2024, and close on Friday, November 22, 2024, offering investors a chance to participate in the growing green energy sector. The company has set a price band of ₹102–108 per share, with a minimum lot size of 138 shares, equivalent to an application amount of ₹14,904.

Gurdeep Singh, Chairman and Managing Director of NTPC Green Energy Limited, shared the company’s ambition to be at the forefront of India’s green energy push. “With increasing environmental concerns and support from the government, we see NTPC Green Energy as a crucial contributor to India’s energy transition goals,” he stated.

Jaikumar Srinivasan, Director of Finance, elaborated on the IPO’s objectives, saying, “This IPO will help us invest in NTPC Renewable Energy Limited for repayment or prepayment of certain borrowings and support our general corporate purposes, enabling us to focus on developing clean energy projects.”

NTPC Green Energy has reported strong financial growth, with revenue surging from ₹170.63 crore in 2023 to ₹2,037.66 crore in 2024 and a profit jump from ₹118.09 crore in 2023 to ₹1,549.46 crore in 2024. Rajiv Gupta, CEO of NTPC Green Energy, emphasized the value this presents to investors: “The company’s performance reflects the rapid expansion in renewable energy capacity and robust operational efficiencies, making NGEL a compelling long-term investment.”

The issue comprises a fresh allotment of 925,925,926 shares and is set to list on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) on November 27, 2024. Retail investors have been allocated a 10% quota, while Qualified Institutional Buyers (QIBs) and High Net Worth Individuals (HNIs) have 75% and 15% quotas, respectively. NTPC Green Energy’s minimum market lot is 138 shares, and retail investors may apply for up to 13 lots, totaling 1,794 shares or ₹1,93,752.

Neeraj Sharma, Chief Financial Officer of NTPC Green Energy, spoke about the company’s achievements in renewable energy: “As of June 2024, NTPC Green Energy’s capacity stands at 14,696 MW, including 2,925 MW from operational projects and an additional 11,771 MW from projects in progress.” Gautam Gaur of HDFC Bank, one of the lead managers for the issue, added, “The IPO reflects investor confidence in India’s renewable energy landscape, underscored by government support and massive private investments.”

Merchant bankers for the IPO include IDBI Capital Markets & Securities Limited, HDFC Bank Limited, IIFL Securities Limited, and Nuvama Wealth Management Limited.

Kindly visit BILKULONLINE You Tube Channel and Subscribe. Thanks. Link for this story below: