Market Outlook: RBI MPC, PMI and global economic data key factors for next week

BILKULONLINE

SUNDAY Special

New Delhi, Dec 1: Indian market outlook for next week will be guided by major domestic and global economic events such as RBI’s interest rate decision, manufacturing and services PMI data, auto sales, US job and PMI data, according to the experts.

Last week, the stock market closed in positive territory due to the victory of BJP-led alliance Mahayuti in the Maharashtra Assembly elections. During this period, Nifty increased by 223 points or 0.94 per cent to close at 24,131 and Sensex increased by 685 points or 0.87 per cent to close at 79,802. However, due to global instability, the market witnessed significant volatility.

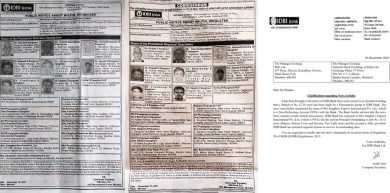

Banking shares played an important role in this rally. Bank Nifty closed at 52,055 with a rise of 920 points or 1.80 per cent. During this period, shares of HDFC Bank, the country’s largest private bank, made a new all-time high of Rs 1,836. Last week, there was a decline in selling by foreign institutional investors (FIIs) on a weekly basis. From November 25 to November 29, FIIs sold Rs 5,026 crore in the cash market.

During this period, purchases worth Rs 6,924 crore were made by domestic institutional investors (DIIs). Vinod Nair, Head of Research at Geojit Financial Services said, “The market movement will depend on the upcoming economic data. The GDP growth rate in the second quarter of FY25 was 5.4 per cent. Its impact on the market can be seen, but investors will be eyeing the RBI MPC.

This time the repo rate is likely to remain unchanged, but due to the low growth rate, the central bank may indicate a cut in interest rates in February. “Other economic indicators like service and manufacturing PMI data, auto sales, and US job data will also influence investors’ attention and shape the market momentum,” he added.

Palka Arora Chopra, Director of Master Capital Services said, “Nifty 50 closed above the 21-day EMA, respecting the 23,800 level as support, and ended positive for the second consecutive week. The 23,800-23,850 zone remains a crucial support; a breach below this could trigger a fall toward 23,400.”