Nexus Select Trust announces ₹3200 crore IPO – opening on May 9

Price Band fixed at ₹95 per Unit to ₹100 per Unit

Anchor Investor Bidding Date – Monday, May 8

Bid/Offer Opening Date – Tuesday, May 9

Bid/Offer Closing Date – Thursday, May 11

Bids can be made for a minimum of 150 Units and in multiples of 150 Units thereafter by Bidders other than Anchor Investors

BILKULONLINE

By Rafat Quadri

Ahmedabad, May 4: Blackstone-backed Nexus Select Trust REIT Ltd’s initial public offer will open for subscription on Tuesday, May 9, and close on Thursday, May 11 The company has fixed a price band of Rs 95–100 per unit. The bidding for anchor investors will open on May 8.

The public issue comprises fresh issuance of units aggregating up to Rs 1,400 crore and an offer for sale of units by the selling unitholders aggregating up to Rs 1,800 crore. The company had earlier planned to raise around Rs 4,000 crore through the initial share sale. The company aims to use the net proceeds towards partial or full repayment or prepayment and redemption of certain financial indebtedness of the asset special purpose vehicles and the investment entity; acquisition of stake and redemption of debt securities in certain asset SPVs; and general purposes, it said in its draft red herring prospectus.

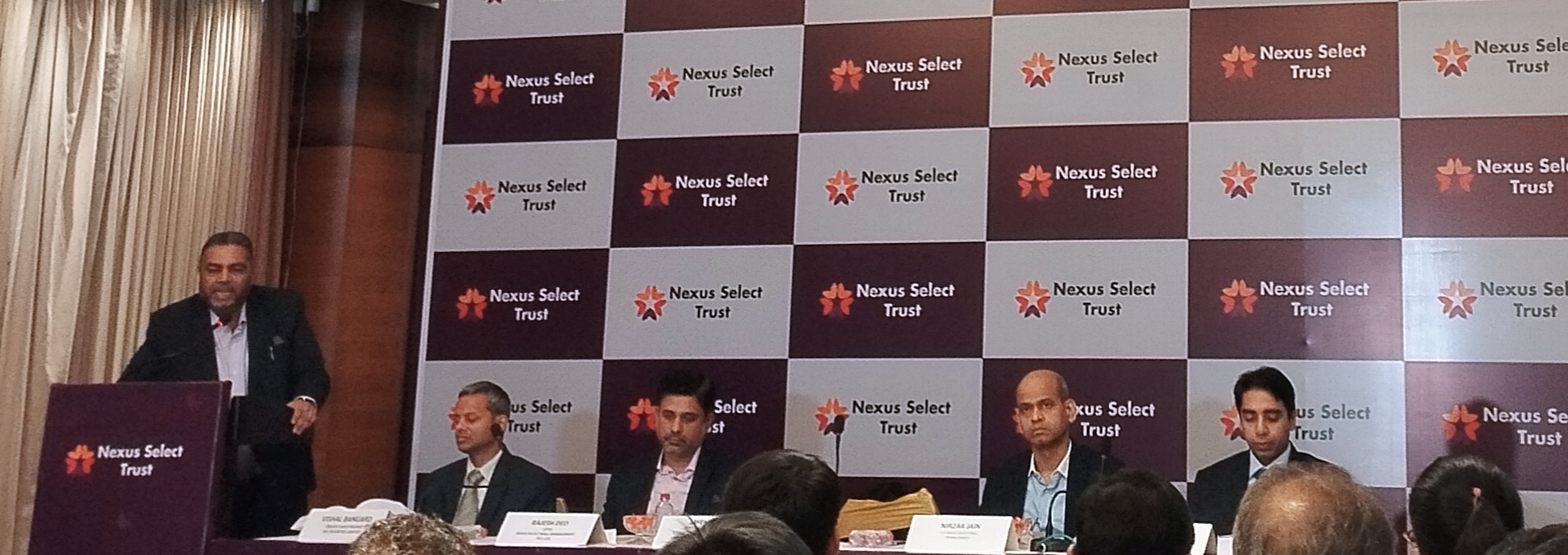

The management team of Nexus Select Trust was in Ahmedabad on Thursday to make this important announcement before the media. Nexus Select Trust is India’s leading real estate investment trust, which represents the real estate portfolio of the globally reputed Blackstone Group. Incidentally, Blackstone is one of the largest institutional investors in the Indian real estate space and has been looking to monetize it through the REIT route.

Chris Heady, Chairman of Asia Pacific and Head of Real Estate Asia, Blackstone, said: “We are thrilled to launch Nexus Select Trust, India’s first retail-focused REIT. This reaffirms Blackstone’s commitment to India, where we have built a strong presence for more than 15 years and participated in the launch of its first two REITs.”

Dalip Sehgal, Chief Executive Officer of Nexus Select Mall Management Private Limited, said: “Nexus Select Trust is India’s largest mall platform and is well-positioned to capitalize on India’s unique consumption tailwinds. We are excited to be at the forefront of India’s retail journey.”

Providing details about the group its Chief Operation Officer Jayen Naik said “Nexus Select Trust is India’s largest mall platform of 17 high-quality assets strategically located in dense residential catchments across 14 prominent cities. The portfolio comprises 17 Grade A urban consumption centres with a total leasable area of 9.2 msf, 2 complementary hotel assets (354 keys), and 3 office assets (1.3 msf) as of December 2022.

The portfolio is also highly stabilized, with committed occupancy of 96.2% and 5.7-year WALE as of December 2022. Nexus Select Trust has fixed a price band of Rs 95-100 per unit for its IPO. Investors can bid for 150 units and in multiple thereof “.

Nirzar Jain the Chief Leasign Officer of Nexus Malls reiterated that “Losses for the Trust narrowed sharply to Rs 10.9 crore for the year ended March 2022 from nearly Rs 200 crore a year ago. Revenue from operations for the period climbed 45.3% to Rs 1,318 crore in the same period. For the three months ended June 2022, the REIT’s net profit stood at Rs 84.6 crore, while revenue was Rs 466 crore.”

Rajesh Deo, Chief Finance Officer of the Nexus Malls Group explained the financial health of the group.

The Book Running Lead Managers to the Offer include BofA Securities India Limited, Axis Capital Limited, Citigroup Global Markets India Private Limited, HSBC Securities and Capital Markets (India) Private Limited, IIFL Securities Limited, JM Financial Limited, J.P. Morgan India Private Limited, Kotak Mahindra Capital Company Limited, Morgan Stanley India Company Private Limited and SBI Capital Markets Limited.

(Rafat Quadri can be contacted at editorbilkul@gmail.com)